Quick Claim Process

Affordable Premium

Life Insurance Companies in India in 2025

Most people view life insurance policies as a form of investment. However, these plans also offer a significant payout upon the death of the insured individual.

Therefore, individuals with dependent family members need to opt for such contingency plans to ensure that their spouse, children, aged parents and siblings are financially secured, even in the event of unfortunate demise.

If a life insurance policyholder perishes during the plan’s coverage term, his/her family members can claim the death benefit.

Doing so will result in a lump-sum financial benefit, which the surviving family members can use to ensure a comfortable life. The various life insurance companies operating in India are responsible for providing these plans and settling claims when they are raised.

Table of Contents

What is a Life Insurance Company?

A life insurance company is an organisation, which creates variegated life insurance policies for its customers. Policyholders pay a premium to the insurance company, which is determined by the sum assured for the chosen coverage, along with other benefits and factors. A life insurance company also needs to handle all claims, which its customers file.

Before extending the financial compensation after a claim is filed, life insurance companies need to verify all information and circumstances of a policyholder’s death. Death by accident or suicide is often excluded from life insurance policy coverage.

Thus, if a policyholder succumbs due to either of these reasons, his/her family members are disqualified from claiming death benefit from the insured life insurance policy.

The following are some of the common types of life insurance policies available in India:

- Unit Linked Insurance Plans

- Term life insurance

- Endowment plan

- Whole life insurance

- Money-Back policy

- Retirement plan

- Child plan

These are the seven different life insurance policy types, each of which is geared to meet various requirements and conditions.

You need to consider your current situation in life to determine which of the policies mentioned above is the best suited to your needs.

List of Life Insurance Companies in India

List of Life Insurance Aggregators in India

An insurance aggregator works as a marketplace that allows users to compare and buy insurance products from several insurers within one website. Thus, acting like a trading platform, aggregators enable buyers to select the most suitable insurance materials based on their price and other characteristics of offered products.

A life insurer is an insurance company that targets individual customers and focuses on delivering relevant products primarily to protect people’s financial situation. These insurers have the critical function of providing quotations for policies, evaluating the insurance risks, and guaranteeing the payment of the policy benefits to the beneficiaries in the event of the policyholder’s demise.

How is the Life Insurance Market in India?

As highlighted in the analysis, the life insurance market in India remains one of the rapidly growing sub-sectors in the nation's financial structure for various reasons, as presented below:

India’s life insurance sector has seen significant growth, with new business premiums increasing by 5.71% year to date as of 2025. Currently valued at nearly $114.6 billion in written premiums, the market is expanding at a compound annual growth rate (CAGR) of 7.3% annually from 2025 to 2029.

India is projected to be the fastest-growing insurance market among G20 countries over the next five years, and it is poised to reach an estimated $222 billion by 2026.

Among emerging economies, India ranks as the fifth most prominent life insurance market, experiencing an impressive annual growth rate of 32-34%.

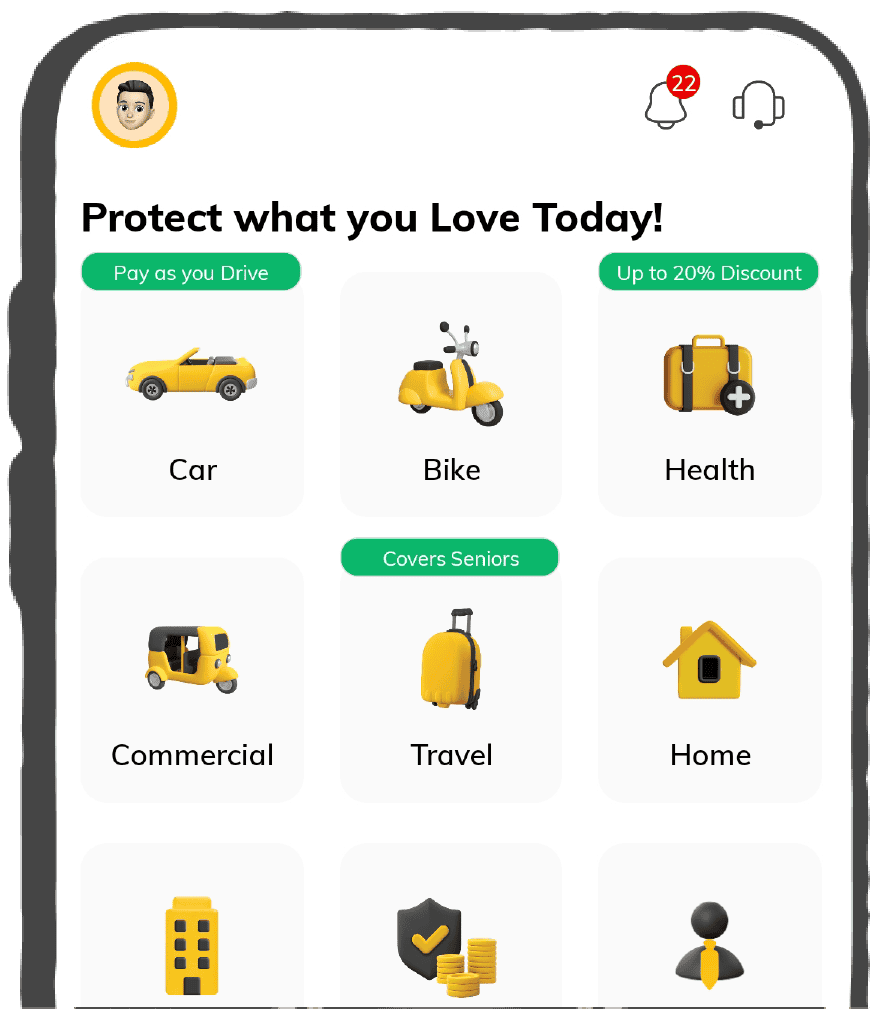

Insurers are leveraging technology to enhance customer experience through online platforms, mobile apps and AI-driven tools.

The IRDAI is implementing reforms to foster growth, such as increasing the foreign direct investment limit and introducing digital initiatives like Bima Sugam.

The life insurance sector is expected to maintain a growth rate of 11% to 13% over the next 3-5 years.

About the market players, the global market comprises organisations and businesses that can be of both state and private ownership. Due to its reach and history, LIC is one of the most famous companies in the public sector, particularly in India.

Legal Frameworks Governing Life Insurance in India

The legal framework for life insurance in India, anchored by the Insurance Act of 1938, ensures stability, transparency, and growth in the sector. This foundational statute governs registration, management practices, and insurance business conduct, providing a robust regulatory base.

The Insurance Regulatory and Development Authority of India (IRDAI) is critical to this framework, established under the IRDAI Act 1999. Here are a few things to keep in mind:

- As the primary regulatory body, the IRDAI oversees insurance and reinsurance activities, enforcing guidelines to promote fair practices, protect policyholders' interests, and foster orderly sectoral growth. These measures uphold market integrity and ensure insurers operate transparently and accountable.

- The IRDAI's regulations enhance India's life insurance framework by stipulating rigorous guidelines for company registration, safeguarding policyholders' funds through prudent investment strategies, and ensuring continual protection throughout policy durations.

- For example, the IRDAI (Investment) Regulations 2016 mandate efficient management of policyholders' funds to maximise returns while mitigating risks. Recent legislative amendments, such as the Insurance (Amendment) Act of 2021 raising the FDI limit to 74%, aim to attract foreign investments, bolster sectoral expansion, and enhance competitiveness.

- During the COVID-19 pandemic, IRDAI promptly issued directives to support insurers, ensuring uninterrupted services, expediting COVID-19 claims processing, and offering flexible premium payment options amidst global uncertainties.

India's robust life insurance legal framework ensures regulatory compliance, supports innovation, and protects consumers. Upholding transparency and adapting to market dynamics maintains sector resilience and meets diverse consumer needs effectively.

IRDAI New Rules for Life Insurance

The Insurance Regulatory and Development Authority of India (IRDAI) has recently introduced several new rules for life insurance policies aimed at enhancing policyholder benefits and ensuring greater transparency. Here are some of the key changes:

- Higher Surrender Value: New regulations mandate a higher special surrender value (SSV) for traditional endowment policies. Policyholders can now receive a portion of their premium back even if they exit after the first year. The SSV calculation includes the present value of the paid-up sum assured, paid-up future benefits, and accrued/vested benefits, discounted at a rate of 10-year government securities (G-sec) plus 50 basis points.

- Know Your Customer (KYC) Requirements: Starting January 1, 2023, mandatory KYC documents are required for all new life insurance policies. This measure aims to enhance transparency and prevent fraud.

- Loans Against Policies: Life insurers must offer loans against policies, providing policyholders greater financial flexibility.

- Flexibility in Policy Terms: Policyholders have increased flexibility in adjusting the tenure of their policies after purchase, accommodating changing financial needs.

- Partial Withdrawals: Linked pension plans now allow partial withdrawals for specific goals, enhancing liquidity for policyholders.

- Minimum Life Cover: A standardised minimum life cover of seven times the annual premium is mandated across all age groups, ensuring adequate coverage for policyholders.

Lower Penalties for Early Exit: The new rules aim to reduce penalties for premature policy exits.

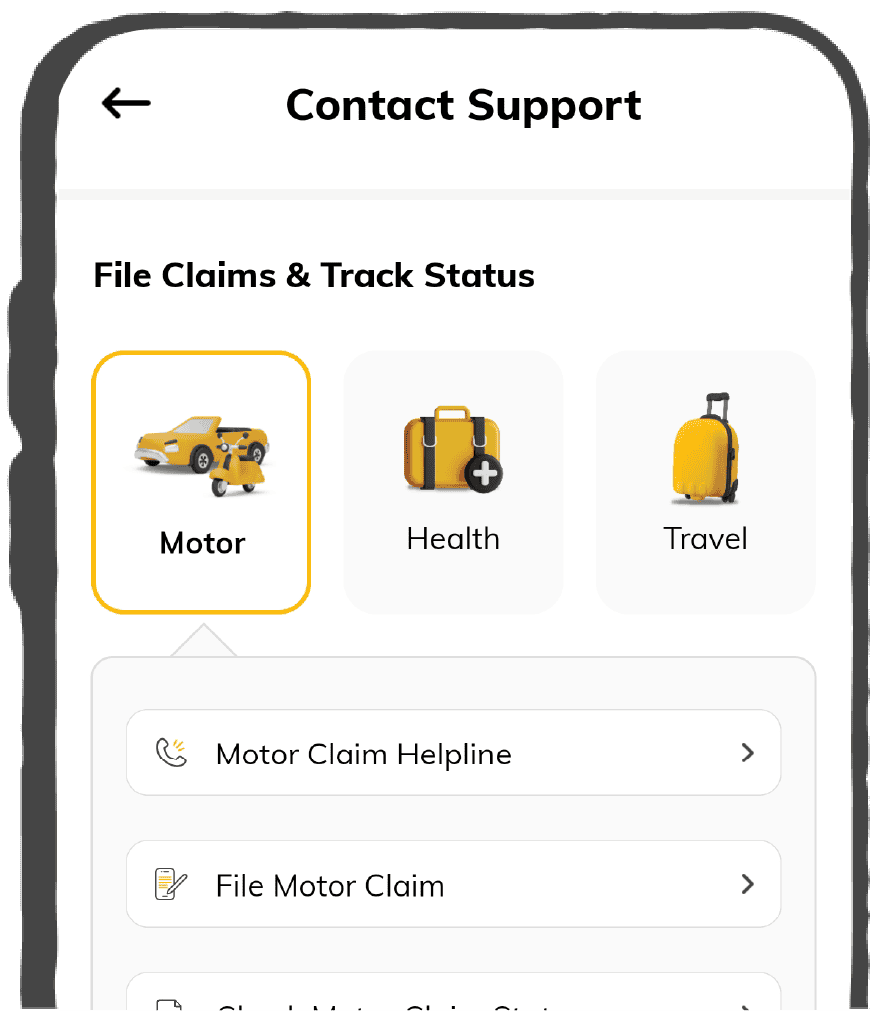

Improved Claim Settlement: The new rules emphasize faster claim settlement, with a target of settling death claims within 15 days, excluding cases requiring investigation.

- Extended Free Look Period: The free look period, allowing policyholders to review and cancel a policy without penalty, has been extended from 15 to 30 days.

Factors to Look for in a Life Insurance Company

Keep an eye on the following characteristics of an insurance company to understand whether it is ideal for your needs:

The Brand Image

This remains relatively easy to measure at present, especially with the aid of the internet. It is as simple as an online search of the insurance provider. Navigate to the public review section. This should assist you in evaluating whether policyholders who are currently out there are content with their decisions.

Should be Approved by IRDAI

The Insurance Regulatory and Development Authority in India, or IRDAI, is an important institution that supervises and develops the insurance field. Business organisations affiliated with this central body will likely implement all the guidelines when handling insurance claims. Furthermore, engaging a registered company is even better since there are no risks of con jobs.

Life Insurance Premiums

While it is good to have financial protection in an accident or even a health hazard, all that you need cannot be enclosed in your yearly life insurance premium. Insurance aggregator portals will enable clients to compare the prices of products offered by different firms, guiding the client on the general price range of such insurance policies.

Claim Settlement Ratio

The claim settlement ratio of a general insurance company shows the kind of help you will receive from the provider during mishappenings. A high settlement ratio means the company pays many claims that policyholders bring forward. As for the claim settlement ratio, a lower number is different from what you want to see.

Network Garages

Each insurance company permits cashless transactions at some authorised garages and workshops. Therefore, more network garages make one likely to be near the other. As such, choosing companies with numerous options for cashless repair centres is essential.

Here are some reasons why purchasing a policy directly from an insurance company is a more intelligent move:

Flexibility in Embarking on Customised Insurance Policies

Auto insurers usually offer fixed-featured insurance packages that car dealers provide. Thus, the option to configure the policy according to your preferences needs to be improved.

Unique Variety of Products and Services

Itcar dealers tie up with a minimal number of insurance companies. Indeed, when you purchase from them, you can only select a policy from the listed companies, not other companies in the market.

No Extra Premium Payments

Insurance firms deal with car dealers on commission arrangements. This implies that when you are getting a policy from them at some rate, a certain amount of that particular rate goes to the dealership's pocket. When you acquire it directly from the companies, you are only billed the price of the preferred policy and not more.

Comparison and Research

Sadly, you do not get the opportunity to compare different policies through dealerships. With comparison, it becomes more accessible, if possible, to get the insurance policy best suited for you.

You must, therefore, read the terms and conditions of every insurance policy you have in this list of comparable insurance.

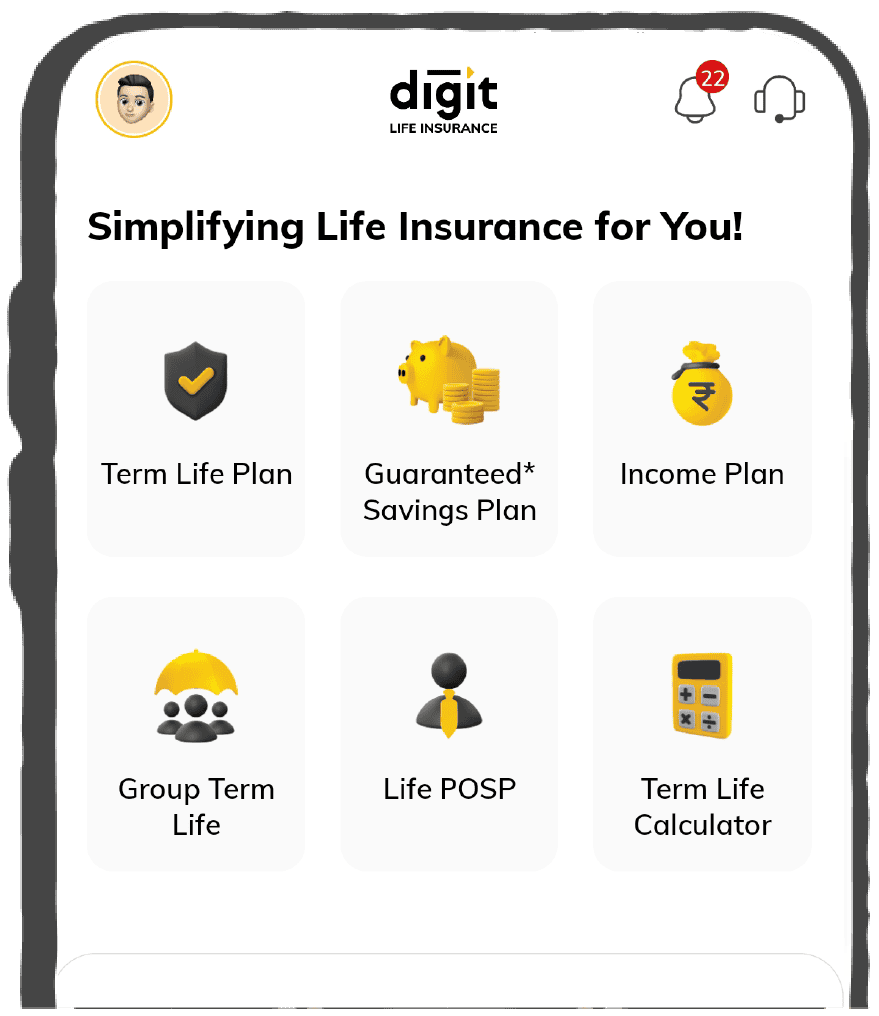

Why Should You Choose Digit for Life Insurance?

Insurance Company vs Insurance Aggregators vs Insurance Brokers

Understand the difference between insurance companies, aggregators and brokers.

Ensure you pick the life insurance company after adequate research. Check the claim settlement ratios, reputation, policy premiums and other benefits before deciding on a plan that suits your specific needs.